Canadian Oil Market Overview: A Beginner's Guide to Safe Investments

The Canadian oil industry presents a unique landscape for beginners looking to make safe investments. With its robust regulatory framework and commitment to environmental stewardship, Canada offers a stable platform for those venturing into oil investments.

Major Players in the Canadian Oil Industry

Canada's oil sector is dominated by several key companies that have established themselves as reliable investment options:

- Suncor Energy: A leader in oil sands development

- Canadian Natural Resources: Known for its diverse portfolio of assets

- Imperial Oil: One of the country's oldest and most established oil companies

- Cenovus Energy: Specializing in oil sands and conventional oil production

Investment Opportunities for Beginners

For those new to oil investments, consider these safer entry points:

- Exchange-Traded Funds (ETFs): Offer exposure to a basket of Canadian oil stocks, reducing individual company risk.

- Blue-chip Oil Stocks: Invest in established companies with strong balance sheets and dividend histories.

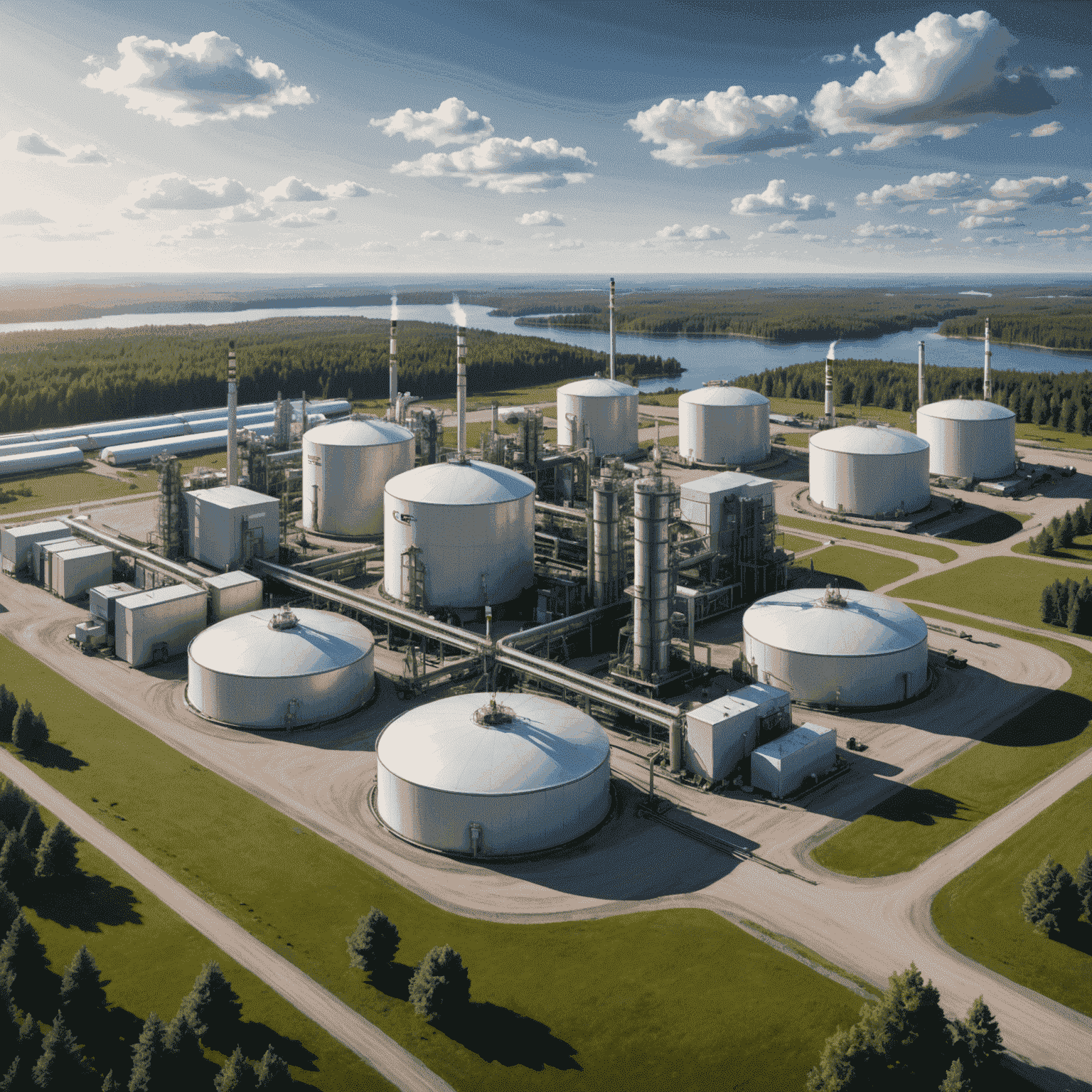

- Midstream Companies: Focus on pipeline and storage businesses, which often have more stable cash flows.

Factors to Consider for Safe Investments

When looking at Canadian oil investments, keep these factors in mind to ensure a safer approach:

- Regulatory Environment: Canada's strict regulations promote industry stability and environmental responsibility.

- Technological Advancements: Companies investing in cleaner extraction methods may offer long-term sustainability.

- Diversification: Look for companies with diverse asset portfolios to mitigate risk.

- Dividend Yields: Many Canadian oil companies offer attractive dividends, providing income alongside potential growth.

The Future of Canadian Oil

While the global push towards renewable energy is undeniable, Canadian oil remains a significant player in the energy sector. The industry's focus on reducing emissions and improving efficiency positions it well for the future.

Investors should keep an eye on:

- Carbon capture and storage initiatives

- Hydrogen production from oil sands operations

- Partnerships with renewable energy projects

Conclusion

The Canadian oil market offers a range of investment opportunities for beginners seeking safer options in the energy sector. By focusing on established companies, diversified assets, and the industry's commitment to innovation and environmental responsibility, new investors can navigate this complex market with greater confidence.

Remember, while no investment is without risk, the Canadian oil industry's stability and forward-thinking approach make it an attractive option for those looking to start their investment journey in the energy sector.